Credit scores can make or break deals, pivotal in your home-buying journey. But here’s the good news: a less-than-stellar credit score doesn’t spell the end of your home ownership dreams. Let’s navigate the twists and turns of securing your mobile home space and bad credit score. Yes, it’s doable, and we’re here to guide you every step of the way. Let’s dive in!

Financing Option | Description | Pros | Cons |

Unsecured loans offered by financial institutions | - Quick processing - Flexible usage | - Higher interest rates - Lower loan amounts | |

Federal Housing Administration loans with lower credit standards | - Lower credit requirements - Lower down payment needed | - Strict requirements for home condition | |

Mortgages designed for buyers with poor credit history | - Possibility to buy a home - May offer refinancing | - Higher interest rates - Risk of negative amortization | |

Leasing the home with an option to buy in the future | - Build credit over time - Secures the current price | - Risk of losing investment - Limited availability | |

Buy directly from the owner with a private loan | - Flexible terms - Faster closing process | - Higher down payment - Legal complexities |

Credit Score Basics

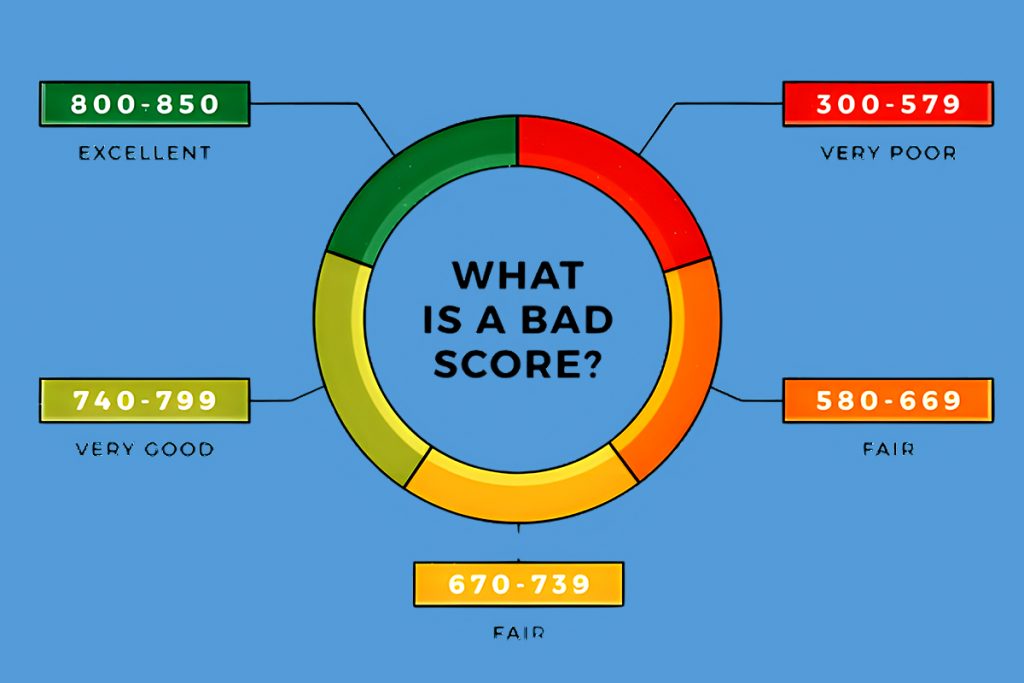

First things first, what exactly is a credit score? Think of it as your financial report card, a three-digit number that tells lenders how trustworthy you are when managing debt. The scores range from 300 to 850, and this little number carries a big weight in your home-buying adventure.

Now, you may be wondering, what’s considered a “bad” score? Typically, anything below 580 is viewed with a bit of a side-eye by lenders. But don’t panic! It’s just a starting point, not set in stone.

So, how does this score come to be? It’s a concoction of your payment history, debts, the length of your credit history, and other financial factors. Picture a pie chart sliced into sections, each representing a slice of your financial life.

Now, let’s chat about how this affects your mobile home dreams. Well, lenders often set the bar for loan approvals based on your score. A higher score might get you a golden ticket to lower interest rates and a smoother sailing through the loan process. Conversely, a lower score means you might have to prove yourself a bit more to lenders, showcasing your reliability in other ways.

But here’s where the silver lining comes in: Buying a mobile home offers more flexibility compared to traditional homes. Yes, your dreams are still within reach, even with a bad credit score. So, hold tight to that dream because understanding your credit score is your first step to unlocking the door to your new home.

Ways to Finance A Mobile Home with Bad Credit

Let’s jump into the financial sandbox where all your mobile home dreams begin to take shape – the financing options. Several pathways lead you to your dream home, even with a bad credit score. Let’s dissect them one by one, shall we?

1. Personal Loans

First off, what exactly is a personal loan? Simply put, it’s a lump sum borrowed from a financial institution, which you pay back in fixed monthly installments. Quite straightforward, right?

Credit Score

Now, let’s talk credit score. Picture a report card of your financial behavior. Generally, a score above 670 is considered good. However, don’t fret if yours is less; many lenders still have your back. We recommend keeping an eagle eye on your score. A higher number might fetch you a better deal.

Interest Rates

Next on the agenda are interest rates. They can be your friend or foe in the loan landscape. Lower scores may face higher rates, but shopping around can help you land a decent rate. It’s all about playing it smart and negotiating your way to a favorable figure.

Down Payment

Moving on to the down payment. Think of this as your initial investment in your dream home. Typically, it’s a percentage of the home’s purchase price. Saving more for the down payment could mean lower monthly installments, a true win-win situation!

Loan Terms

Up next, loan terms. This refers to the life span of your loan, which can range from one to seven years, sometimes even more. Longer terms mean smaller monthly payments but remember, you’ll end up paying more in interest over time.

Pros

On the bright side, personal loans come with quick processing and flexible usage. You get the freedom to use your loan how you see fit, and the speedy approval can be a real game changer when you find your dream home.

Cons

However, it’s not all sunshine and rainbows. The flip side involves higher interest rates and generally lower loan amounts. Yes, it might be a bit tougher, but remember, it’s a viable path to securing your dream space.

2. FHA Loans

What are FHA loans? Simply put, these are loans backed by the Federal Housing Administration. They’re designed to help lower-income and first-time homebuyers qualify for a mortgage.

Credit Score

Next up, let’s talk credit scores. FHA loans are forgiving; you can score as low as 500! Generally, a score between 500 and 579 necessitates a 10% down payment, while a score of 580 or higher allows for just 3.5% down. It’s like a little window opening up, offering you a helping hand to grab that dream of yours.

Interest Rates

Now, on to interest rates. Typically, they’re competitive, perhaps even slightly lower than your standard home loans. The best part? Fixed and adjustable rates are available. It’s all about choosing what works for you creating a home buying journey tailored to your needs.

Down Payment

Swinging over to down payments. As mentioned before, a stellar feature of FHA loans is the lower down payment requirement. It’s genuinely a great boon for many, making that dream home just a bit more attainable. Remember, every little bit saved is closer to unlocking your new front door.

Loan Terms

Digging into loan terms here. FHA loans offer a gamut of options ranging from 15 to 30 years. This range allows you to choose a term that fits your financial situation like a glove, making the repayment process a breeze.

Pros

Lower down payments and more lenient credit score requirements stand tall in the pro column, opening doors for many aspiring homeowners. They are a beacon of hope, offering a pathway to homeownership where there might not have been one before.

Cons

Despite the lower barriers to entry, FHA loans often come with costly insurance premiums and might have stringent property condition standards. It’s all about weighing the pros and cons to find your perfect fit.

3. Subprime Mortgages

So, what’s the deal with subprime mortgages? Well, they’re kind of a second chance loan for those with lower credit scores. These loans tend to be more accessible, but they come with their own set of characteristics.

Credit Score

A lower credit score, below 640, is generally acceptable in subprime mortgages. It’s like having a friend who doesn’t judge you by your past. But remember, this friendliness comes at a price.

Interest Rates

Speaking of which, let’s talk about interest rates. Generally, they’re higher compared to conventional loans. Given the higher risk involved, it’s the lender’s way of securing themselves. So, while it opens doors, it does ask for a bit more in return.

Down Payment

Subprime lenders might ask for a substantial down payment. It’s their way to share the risk with you. The good news? You have a shot at home ownership; the flip side is that it comes with a higher upfront cost.

Loan Terms

Exploring the loan terms. Here’s where it gets a bit intricate: these loans can come with varying terms, including adjustable rates, which means your payments can increase over time. It’s a dynamic process, like a seesaw, balancing out over time.

Pros

The standout pro here is the opportunity it offers; it allows individuals with a not-so-great credit score to secure a home loan. It’s like getting a wildcard entry into the homeownership game.

Cons

High-interest rates and potentially fluctuating payments can be a downside. Moreover, there’s a risk of negative amortization when you owe more than you initially borrowed. A bit of a tightrope walk, isn’t it?

4. Lease to Own Option

First up, what does “lease to own” mean? It’s like taking a car for a test drive before buying it but for a much longer period. You lease the home with the option to purchase it down the line. It’s literally home-buying with a trial period.

Credit Score

Next, we venture into credit score territory. The great news is that this option can be more forgiving to those with a lower credit score. It’s like being given a chance to prove yourself, showing that you can be a reliable homeowner in the future.

Interest Rates

Now, let’s dive into interest rates. Technically, you aren’t tied to a mortgage during the lease period, which means no interest rates apply just yet. It’s like a pause button, giving you time to better your financial stance before diving into interest rates.

Down Payment

Let’s chat about the down payment. Typically, you pay an option fee upfront, considerably less than the traditional down payment. It’s like a minor entry ticket to your potential future home. This fee might even go towards your down payment when you decide to buy. A neat little bonus, wouldn’t you say?

Lease Terms

During the lease term, which usually lasts several years, you agree on a purchase price for the home. It’s essentially setting a price tag for the future, like reserving your dream home at today’s price.

Pros

The standout here is the ability to lock in a purchase price while working on improving your financial health. Plus, it’s a great way to test out the neighborhood. Think of it as a try-before-you-buy scenario that works to your advantage.

Cons

However, there are cons to consider. If you opt not to buy, you could lose your option fee and any premium payments made. It’s a bit like a bet; you’re banking on a brighter future and being ready to make that big purchase.

5. Owner Financing

Imagine buying a home but skipping the traditional lender route altogether. Instead, you make your mortgage payments directly to the seller. That’s owner financing in a nutshell. It’s like a personalized path to home ownership.

Credit Score

Owner financing often brings more lenient requirements to the table. The seller might not scrutinize your credit score as closely as a traditional lender. It’s a scenario where your negotiation skills can shine, crafting a deal that works for both parties.

Interest Rates

Swinging over to interest rates. Here, there’s a good bit of flexibility, too. You and the seller agree on a rate that works for both, which could be a win-win, setting a rate that feels fair and manageable. Think of it as a collaborative effort to find that perfect middle ground.

Down Payment

Now, let’s discuss down payments. Often, this aspect is highly negotiable, too. Sellers might opt for a substantial amount to secure the deal. Yet, it’s all open terrain, ready for a mutually beneficial agreement. It’s like setting the stage for a home-buying journey built on trust and understanding.

Loan Terms

Next up, loan terms. Generally, these tend to be shorter, meaning you might be looking at a faster route to full ownership. It’s a sprint, not a marathon, where every stride is carefully planned and agreed upon.

Pros

It’s time for the pros. Besides the potential for a faster closing process, the tailored agreement can stand in your favor, offering a unique, custom-made home-buying experience. It’s a pathway that puts you and the seller in the driver’s seat, navigating towards a successful end goal together.

Cons

Lastly, the cons. Despite the flexibility, this road comes with risks, including potential balloon payments down the line. It’s a journey that requires a keen eye on the fine print to avoid bumps. Consider it a route where a good roadmap, in the form of a well-crafted agreement, is your best companion.

Tips for Securing a Mobile Home with Bad Credit

Let’s navigate the roadmap to securing a mobile home with a not-so-perfect credit score.

1. Research and compare

First off, consider this your homework phase. You’ll want to get the lay of the land, checking out different lenders and what they offer. Think of it as shopping for the best deal, a process where the more you know, the better it gets.

2. Improving credit score

Next up, let’s focus on elevating that credit score. Small steps can make a big difference. From paying down debts to keeping credit card balances low, every bit helps. It’s like grooming yourself for a grand event; you want to put your best foot forward when you step into the lending marketplace.

3. Sizable down payment

Now, moving on to the down payment strategy. Saving up for a hefty down payment can increase your chances of securing a loan and potentially snag you a better interest rate. It’s like coming to the table with a strong hand in a card game; the more you have to offer, the better your standing.

4. Seeking expert advice

Don’t overlook the power of expert advice. Consulting with a professional can help steer you in the right direction, giving you the insight you need to make informed choices. It’s having a seasoned guide while exploring uncharted territories and a reassuring presence to help navigate the complexities of home financing.

5. Legal consultation

Lastly, we can’t stress enough the importance of legal consultation. Before you sign on the dotted line, having a legal expert review the terms can save you from potential pitfalls. It’s like having a safety net, ensuring you land on solid ground even as you take a big leap toward your dream home.

Conclusion

Navigating the path to homeownership with a less-than-perfect credit score can feel like a steep climb. But guess what? With the right strategy, it’s doable. Whether you’re leaning towards a lease-to-own option or considering a generous owner-financing deal, a world of opportunities is at your fingertips. Remember to play your cards smartly — do your research, bolster that credit score, and seek expert guidance.