Homeownership doesn’t always mean a traditional house with a white picket fence. Enter the versatile world of mobile home park loans. In a nutshell, these loans grease the wheels for your home-on-the-go dreams. They are financial tools specifically designed to help you become the proud owner of a mobile home. Think of it like a golden key, opening doors to vibrant communities and a home that matches your style, budget, and needs. So, let’s dive in!

Loan Type | Summary | Tips |

Unsecured loans that are based on your creditworthiness. Generally, they have higher interest rates and shorter terms compared to other loan options. They offer a great deal of flexibility as they are not restricted to home or property purchases. | Look for lenders offering the best interest rates and be sure to read the fine print regarding fees and penalties. | |

These are loans where the mobile home itself serves as the collateral. Generally, they have higher interest rates compared to mortgage loans but the loan approval process is faster. Ideal for home buyers who do not own the land beneath their homes. | Focus on lenders specializing in mobile home loans and always ensure you have a clear understanding of the interest rates and terms before signing. | |

Secured by the real estate itself, offering lower interest rates compared to personal and chattel loans. These loans have longer terms, providing stability but requiring a substantial down payment. | Aim to secure a loan with a favorable interest rate, and remember that a larger down payment can result in lower monthly payments. | |

Federal government-backed loans providing buyers with low-to-moderate incomes an opportunity to secure a home loan with a lower down payment. They come in two types, Title I for home improvements and Title II for buying or renovating homes. | Work with FHA-approved lenders and ensure to meet all the FHA requirements, including minimum credit scores. | |

Specifically designed for veterans and their spouses, these loans offer several benefits including no down payment and no private mortgage insurance (PMI) requirement. Ideal for eligible veterans looking for competitive interest rates. | Obtain a Certificate of Eligibility (COE) through the VA to ensure you meet the necessary service requirements. |

What Is A Mobile Home in A Park?

Okay, let’s discuss what we mean by “mobile homes in parks.” It might sound pretty straightforward, but there’s more to it than meets the eye.

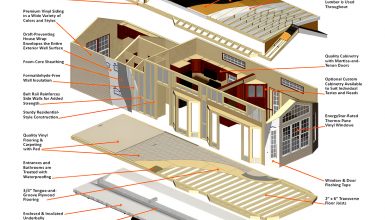

Picture a cozy, compact home that has all the essentials you need. It’s a home built in a factory and then transported to its resting place in a specially designed park. Yes, you got it right; it’s not constructed brick by brick on a plot but arrives all set, ready to welcome you.

Now, onto the park aspect. These parks are, frankly, a genius invention. Think of a community of similar homes nestled close to each other. They share common facilities like a playground, perhaps a swimming pool, and even a clubhouse for neighborhood gatherings. It’s like having a mini-village of mobile homes. And the best part? The sense of community is strong here, with neighbors knowing each other, fostering a warm, friendly vibe like a breath of fresh air in today’s fast-paced world.

Lastly, mobile home parks often offer fantastic amenities – we are talking laundromats, fitness centers, and sometimes even convenience stores right at your doorstep. It’s all about making life easier and more enjoyable for the residents.

Types of Loans for Mobile Homes in Parks

These loan types offer unique benefits tailored to different situations and needs. As you weigh your options, consider your long-term financial goals, loan term preferences, and what you feel most comfortable committing to.

1. Personal Loans

First, personal loans are like the versatile, reliable friends in the financial world — they’ve got your back for many needs, including snagging that mobile home you’ve been eyeing.

Loan Amount

Let’s talk numbers. Lenders might be willing to give you anywhere from a few thousand to upwards of $50,000. But, the golden rule? It largely hinges on your credit score and income. The better they are, the more you can borrow.

Loan Term

Next on the agenda is the loan term. Typically, we’re looking at a period between one and seven years. Yes, you heard right; it gives you a comfy time frame to pay back without rushing you.

Pros

Now, let’s chat perks. Personal loans come with fixed interest rates — meaning no nasty surprises along your repayment journey. Plus, they usually don’t require collateral, so your assets can take a breather. And let’s not forget the speed; you can get a personal loan pretty fast, sometimes within 24 hours.

Cons

But hold on, it’s not all smooth sailing. We’ve got to talk about drawbacks, too. First off, those interest rates? They can be on the higher side compared to other loan types. And if your credit score isn’t precisely beaming? You might find yourself facing some steep rates.

Moreover, since personal loans aren’t designed exclusively for mobile homes, they might not cover all the costs. Yep, it means you might need a good chunk of savings.

So, there we have it. Personal loans offer a speedy, no-collateral-needed path to securing your mobile home. However, tread wisely to navigate the potential pitfalls.

2. Chattel Loans

So, you’re steering towards buying a mobile home and stumbled upon chattel loans in your research? You’re in the right spot to decode what it’s all about!

Loan Amount

Chattel loans are essentially loans secured by the mobile home itself. So, what about the digits involved? It’s quite a range; you can look at anything from $7,500 to well above $300,000. The actual figure? It swings heavily based on your credit score, the home details, and the lender’s terms.

Loan Term

Transitioning to the loan term is generally shorter than traditional home loans. We are talking about a span of 15 to 20 years. That means a quicker path to full ownership, but shorter terms also mean higher monthly payments.

Pros

Now, onto the bright side of things! Chattel loans usually have a simpler, faster approval process. Plus, they often come with lower upfront costs, a real budget-saver when you are eager to move in swiftly.

Cons

One notable hiccup is the interest rate. Yep, it tends to be higher than that of regular mortgages. And while we’re on that, being a property-type loan, it doesn’t offer the advantage of building equity in the land since it’s just the home on loan.

Moreover, with chattel loans, it’s often a tighter rope walk with stricter credit score requirements. And because it’s a shorter-term loan, be prepared for those steeper monthly payments we discussed.

So, while chattel loans can be a great ally in your mobile home buying journey, offering speed and lower initial costs, it’s a path dotted with higher interest rates and a bit of a rigid stance on credit scores.

3. Mortgage Loans

Next, let’s chat about mortgage loans, the classic path that has guided many to their dream homes. Ready to take the first step? Let’s walk through it together!

Loan Amount

First on the list is the numbers game. Maximum loan amounts are pretty expansive, depending on your credit history, income, and the lender’s terms. Generally, it can stretch from $50,000 to even a couple of million dollars for those eyeing a lavish space. So, what is your dream home size? It’s pretty much your canvas here!

Loan Term

Moving right along to loan terms. Here, we have options aplenty: think 15, 20, or even 30 years. Yes, it’s a long road, but a stretched-out payment schedule means smaller monthly payments, making it a softer landing on your wallet month-to-month.

Pros

Alright, it’s time to highlight the pros. Mortgage loans often offer lower interest rates — a massive bonus over time. Plus, they pave the way for home equity loans in the future, giving you a financial cushion to lean on down the line. Oh, and let’s not overlook the potential tax benefits of mortgage interest; it’s a perk many appreciate.

Cons

Mortgage loans generally involve a more rigorous approval process — we’re talking more paperwork and longer waiting times. Also, longer loan terms mean you end up paying more interest over the loan’s lifetime. And yes, let’s not skirt around the hefty down payment often required; it can be a substantial initial pocket pinch.

All in all, mortgage loans can be fabulous, with lower interest rates and potential tax benefits. But remember, it’s a path with hurdles, including a substantial down payment and a more extensive application process.

4. FHA Loans

Step right into the welcoming arms of FHA loans, a favored choice for many home buyers, especially the first-timers. Wondering why? Let’s decode it bit by bit.

Loan Amount

First up, the numbers. FHA loans have limits that vary significantly depending on your location, hovering generally between $23,226 and $93,000.

Loan Term

Next in line is the loan term. Here, flexibility is king, offering terms like 15 and 25 years. Essentially, it means you can pick a term that suits your financial comfort zone—striking a balance between monthly payments and the loan’s lifespan.

Pros

Now, it’s pro time! FHA loans are a champion for those with lower credit scores, ushering them into the home-owning club with open arms. And here’s the cherry on top: it comes with a lower down payment requirement, often as low as 3.5%. Yes, it’s a smaller hurdle to cross to securing that dream home.

Cons

Swinging over to the cons, we find that the lower barriers to entry come with a catch. FHA loans often saddle you with higher monthly insurance premiums. Plus, an upfront mortgage insurance premium adds to your initial costs.

And let’s not forget those generous loan limits? They might still cramp your style if you are eyeing a home in a pricier neighborhood.

In short, FHA loans come with goodies, including welcoming terms for first-time buyers and those with not-so-perfect credit scores. Yet, they bring a set of added costs that can stack up over time.

5. VA Loans

Lastly, it’s time to tackle VA loans, a fantastic option to honor our veterans and active-duty service members. Yes, it’s exclusively crafted just for you, offering many benefits. Let’s delve into it!

Loan Amount

First off, let’s talk numbers. Technically, there isn’t a maximum limit set by the VA. Still, lenders generally cap it based on your income and credit score. So yes, there’s room to dream big, albeit within your financial canvas. It’s all about striking that perfect balance!

Loan Term

Shifting gears to loan terms, we find familiar friends here – typically spanning 15 to 30 years. What does it mean for you? You can choose a path that suits your financial pace, allowing you to comfortably settle into your new nest without feeling the pinch.

Pros

On to the brighter spots! One of the standout perks is the zero down payment feature — yes, you heard it right, zero! Plus, bid farewell to private mortgage insurance, a usual suspect in many loan types. And let’s appreciate the competitive interest rates that VA loans flaunt, easing your journey to homeownership substantially.

Cons

But let’s not glide past the cons. Though you’re saving on the down payment, there is a VA funding fee to factor in, which could vary depending on various elements, including your service details. Also, the home needs to be your primary residence; sorry, there are no investment properties or vacation homes on this route.

Moreover, getting through the VA appraisal process can be more stringent than other loan types. Yep, they maintain a high standard to ensure you step into a safe and sound home.

Remember, VA loans come with a golden package of benefits, especially regarding down payments and interest rates. Yet, it carries its nuances to navigate, with specific fees and home use stipulations.

Eligibility Criteria

Now that we’ve wandered through the different types of loans, it’s high time we chat about the numbers that will play a pivotal role in your mobile home-buying journey: the eligibility criteria. Strap in as we break it down!

1. Credit Score

First things first, let’s talk about credit scores. This is your financial report card, and yes, grades matter! Generally, you’re looking at a score of 620 or more for conventional loans. Venturing into FHA territory? You might get a nod with a score as low as 500.

2. Debt-to-Income Ratio

Next on our list is the debt-to-income ratio, a crucial number that lenders scrutinize. Essentially, it compares your monthly debts to your monthly income. A good rule of thumb? Keeping it below 43% can put you in a sweet spot with lenders.

3. Down Payment

Moving forward, let’s spotlight the down payment. It can range widely, from zero in the marvelous world of VA loans to 3.5% for FHA loans and upwards to 20% for conventional loans. So yes, there’s a spot for every budget here.

4. Employment History

Shifting the focus to employment history, lenders love stability. A two-year employment history at your current job is typically golden, showcasing a steady income flow. But fret not; other income proofs can also save the day.

5. Loan-to-Value Ratio

Lastly, we dance with the loan-to-value ratio, which tells lenders how much risk they are taking on you. A lower percentage means a sweeter deal on your loan terms. So yes, this is a number you want to keep as low as possible, aiming for that favorable interest rate.

The Application Process

The application process is the pivotal pathway between you and your dream mobile home in a cozy park. Yes, it’s a big deal, and we’ve got all the insights to get you through it like a pro!

1. Research

First things first, it’s research time! Start with scouting potential lenders. Banks, credit unions, or mortgage brokers – explore all avenues. Remember, it’s your playground; choose the lender who understands your vision and offers terms that have you nodding in agreement.

2. Pre-Approval

Next up is the pre-approval stage, a golden ticket that showcases your buying power. Here, lenders peek into your financial health, evaluating your credit score, employment history, and other financial credentials. Yes, it’s about putting your best financial foot forward, so get those numbers in shipshape!

3. Documentation

On to documentation, a step that calls for meticulousness. You will gather important documents – tax returns, pay stubs, and bank statements. Picture this stage as collecting the golden keys that unlock the doors to your future home; every detail counts!

4. Loan Application

Now, the moment of action arrives with the loan application. This is where you officially state your intent to borrow. Fill in the application form accurately, articulating your loan type, the amount, and all necessary details. It’s like painting a detailed portrait of your financial self with no brushstroke out of place.

5. Appraisal

Moving forward, we venture into the appraisal phase, a critical eye that assesses the value of your soon-to-be home. Yes, it’s a spotlight on the home, unveiling its worth in the current market. So, fingers crossed for a valuation that echoes your offer!

6. Closing

And finally, the grand finale: closing. Here, all the paperwork comes to fruition as you sit down to seal the deal. It’s a meticulous review of all documents, followed by signing on the dotted line. Then, the magical moment arrives the exchange of keys, and voila, the home is yours!

Conclusion

By exploring the landscape of loans available for mobile homes in parks, we’ve unraveled the rich tapestry of options, each offering a unique path to home ownership. From FHA to VA loans and everything in between, it’s clear that a world of opportunities awaits. So, here’s to taking that bold step, armed with knowledge and ready to make that dream home a vibrant reality.