Mobile homes can be an excellent option for veterans. They cost less than traditional houses. They also offer more flexibility. You can place a mobile home on land you own or rent a space in a community. That means you have more control over your living situation. Plus, mobile homes often have lower upkeep costs. This helps veterans who want to stretch their budgets further. You still get a comfortable space without spending a fortune. It’s a smart choice if you wish for both freedom and affordability. Here are some popular loan options for veterans who want to buy a mobile home:

1. VA-Guaranteed Loans for Manufactured Homes

VA loans can help veterans finance a mobile or manufactured home. To qualify, you must meet VA service eligibility rules. You also need to plan on living in the home full-time.

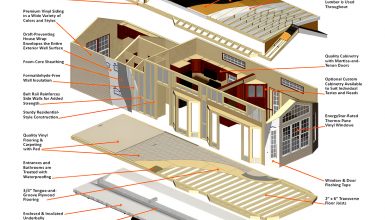

The VA sets specific safety standards to protect you and your family. These standards include particular foundation and structural guidelines. That way, the home is safe and secure. With a VA loan, you often need a smaller down payment than other financing options. The VA also offers more favorable terms, like lower interest rates. This can save you money in the long run.

2. Private Lenders with VA Approval

Many private lenders work with the VA to offer home loans. Banks and credit unions follow VA rules but can set their own rates and fees. It’s wise to compare a few lenders to find the best deal. You can start by asking about current interest rates and any extra charges. Also, look into closing costs. Some lenders may waive or reduce certain fees for veterans. When you review loan offers, make a list of pros and cons. This helps you see the big picture. You’ll know which lender offers the best package for your needs.

3. FHA Title I Loans

FHA Title I loans help people buy mobile or manufactured homes. They come from private lenders but are insured by the Federal Housing Administration. This insurance reduces the lender’s risk. It also helps borrowers get better loan terms, like lower down payments. Veterans can use Title I loans too. They are not VA-exclusive. That means you can still enjoy many benefits without going through the VA process. One key feature is combining a Title I loan with another loan. This lets you cover the cost of the land and the home. As a result, you have fewer bills to juggle. Before you apply, make sure the home meets HUD safety standards. These rules keep you and your family safe.

4. USDA Loans

USDA loans support homebuyers in rural areas. They aim to help low- to moderate-income buyers. With a USDA loan, you can finance certain manufactured homes if they meet specific guidelines. This includes size, foundation, and property location requirements. One big plus is the option for zero down payment if you qualify. However, you must meet income limits set by the USDA. The property must also be in an approved rural location. Always check eligibility maps on the USDA website. That way, you know if your land or desired home fits the criteria. If your income and location pass the test, a USDA loan can be a great way to save on housing costs.

5. Chattel Loans

Chattel loans finance only the mobile home itself. They do not include the land under it. Because of this narrow scope, interest rates on chattel loans tend to be higher. That can lead to bigger monthly payments. Many lenders still offer these loans to veterans, though. So you should ask if they provide special deals or lower rates. A chattel loan can work well if you lease land or stay in a mobile home park. It helps you buy the home even if you do not own the property. Always compare rates and closing costs before you sign. That way, you choose the best financing for your situation.

Tips

Before settling on a loan, ensure the lender supports your chosen program. Not all lenders offer every financing option. Ask if they do VA, FHA, or USDA loans. This step saves you time and prevents confusion later. Next, plan for closing costs. You might face fees for appraisals, inspections, or loan origination. These can add up quickly. Also, remember that mobile homes need regular upkeep—factor in costs for repairs, lot rent (if required), and utilities. Finally, do not be afraid to seek expert guidance. You can talk to a housing counselor, a trusted lender, or the VA. That way, you make the best choice for your budget and your future.